Read our Supply & Demand Snipper review: a Twitter-based trader sharing chart snapshots, S&D setups, and motivational insights. Great for learning supply & demand trading, but not a structured signal service.

Supply & Demand Snipper Review: A Twitter-Based Guide to S&D Analysis

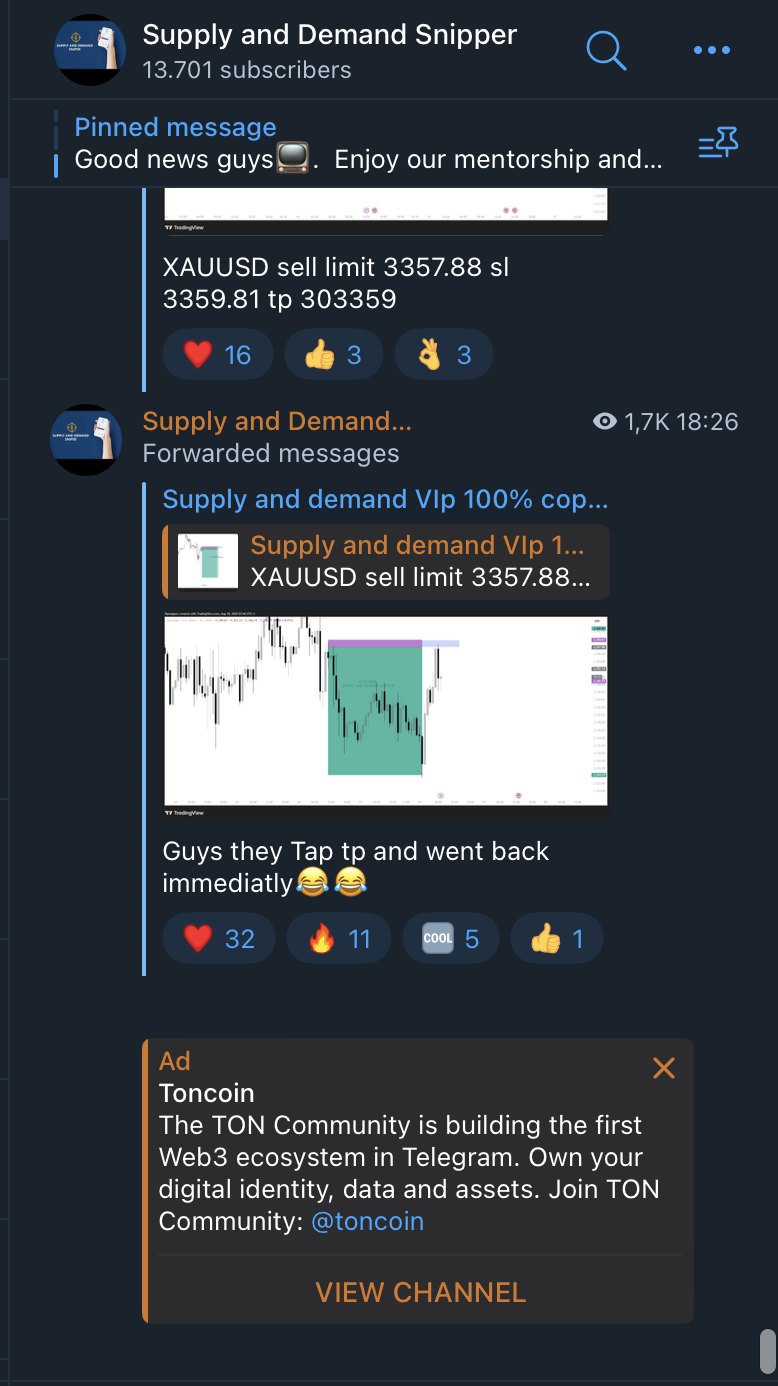

Supply & Demand Snipper, presents itself as a trader focused on sharing insights and educational content on Supply & Demand (S&D) analysis. The account posts concise chart snapshots and motivational messages, aiming to attract and mentor traders who are interested in this specific methodology. The approach is more about providing visual guidance and a framework for personal analysis rather than delivering a formal, structured signal service.

Key Features

This service is defined by its low-friction, social media-based style of engagement. Here's a breakdown of what the service offers:

- Platform: The primary platform is Twitter (X), which serves as a public-facing hub. It's possible this presence is used to redirect a more engaged audience to a private channel like Telegram.

- Content Focus: The content is heavily focused on visual S&D setups and chart references, which are great for traders who learn by observing real-world examples.

- Methodology: The trading style emphasizes identifying key reversal zones using price structure, a core concept of S&D and Smart Money Concept (SMC) trading.

Selective & Educational: Posts are selective and infrequent, suggesting a focus on high-quality setups. The inclusion of motivational quotes also points to a goal of fostering a disciplined trading mindset.

Member Insight & Considerations

The benefits of a free, educational service must be balanced against the need for personal due diligence.

Final Verdict

Supply & Demand Snipper acts as a low-profile, chart-focused mentor on Twitter. His approach is well-suited for traders who are interested in learning S&D analysis through visual charts and selective trade ideas. However, it is crucial to understand that this is not a formal signal service.

Without a formal system or transparency around performance, individuals should treat these insights as educational guidance rather than financial advice. To evaluate its real-world effectiveness, it’s wise to combine his chart cues with your own backtesting and use them as a supplementary input to your personal trading strategy.