Explore Forex Manipulation Signals, a service designed for swing traders with structured setups, 5x reward-to-risk strategies, and funding challenge guidance. Learn its features, pros, and considerations before joining

Forex Manipulation Signals Review: Structured Signals for Swing Traders

Forex Manipulation Signals offers a comprehensive signal service for swing and short-term traders, focusing on high risk-reward setups. This platform is built for traders who want to make consistent, calculated moves, especially during the active London and New York trading sessions. It also comes with a robust risk management framework and guidance for passing funding challenges, making it an all-in-one solution for serious traders.

Key Features

The value of this service is in its detailed, educational approach to trading. Here’s a breakdown of what you get:

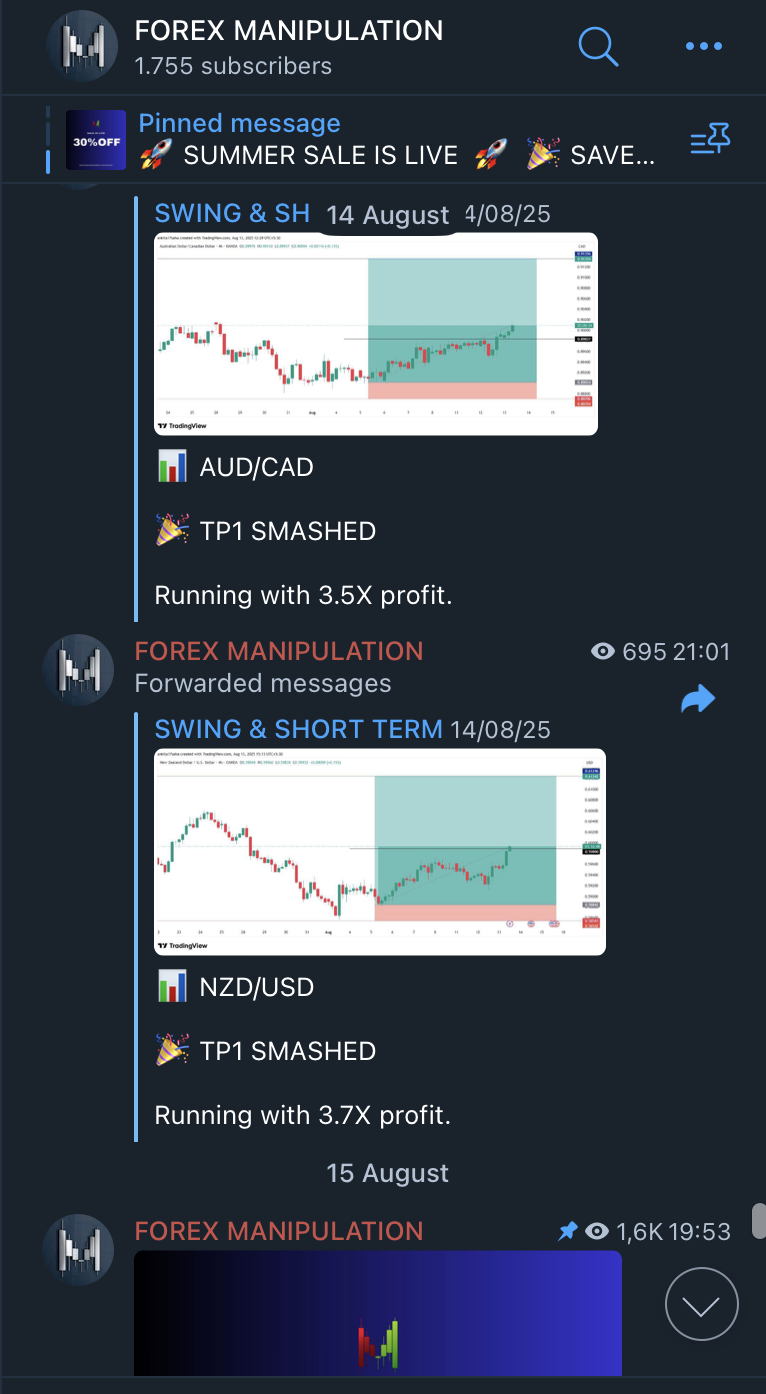

- Swing & Short-Term Signals: Expect 5–10 trade setups per week. Each signal is optimized for the London and New York sessions and includes clear entry, stop-loss, and take-profit levels.

- High R:R Strategy: The strategy is built on a high reward-to-risk ratio, with an average reward size of about 5 times the risk. This allows for a potential 25–40% monthly return by risking just 1% per trade.

- Multiple Subscription Plans: You can choose from various plans—Professional, Skilled, and Novice—with different levels of mentorship, group access, and support for funding programs.

- Comprehensive Support: The package includes a risk management course (PDF and video), live weekly sessions via Zoom, recorded market forecasts, broker selection guidance, and dedicated support.

- Funding Challenge Guidance: The service specifically helps you prepare for prop trading assessments with helpful PDFs and video walkthroughs.

Real-Time Updates: Analysts provide live updates for trade entries, break-even adjustments, and partial closures to help you manage your positions effectively.

Pros & Considerations

Every service has its strengths and things to keep in mind. Here’s a quick summary of what makes Forex Manipulation Signals stand out and what you should be prepared for.

Who Should Consider It?

This service is a great fit for traders who:

- Are seeking well-researched swing setups with high reward-to-risk ratios.

- Are aiming to pass prop trading funding challenges like FTMO.

- Value a structured education, mentorship, and live interaction.

- Are ready to commit to a disciplined trading approach supported by clear guidelines.

Final Verdict

Forex Manipulation Signals offers a refined and educational approach to trading, combining high R:R setups with mentorship and prop challenge preparation. With structured plans, analyst support, and timely updates, it’s tailored for disciplined traders aiming for growth and consistency.