Discover Elliott Wave Count, a Twitter channel providing free market analysis through Elliott Wave Theory. See if this approach can help your trading decisions.

Elliott Wave Count Review: Market Analysis Through Elliott Theory

1. Overview

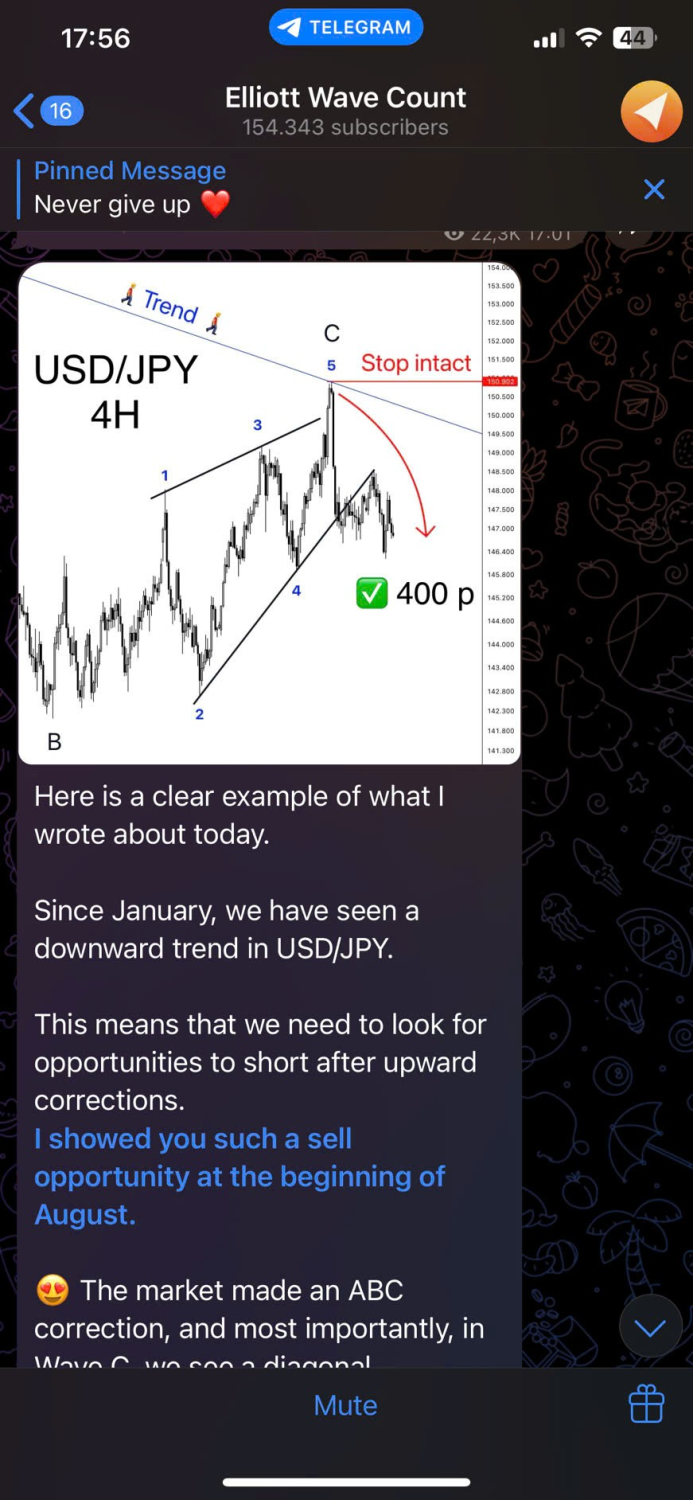

Elliott Wave Count is a Twitter-based channel dedicated to applying Elliott Wave Theory to financial markets. The channel regularly shares annotated charts with detailed wave counts, aiming to help traders visualize potential trend continuations and reversals. By providing free and frequent updates, Elliott Wave Count has built a community of traders interested in advanced technical analysis.

2. Services & Features

- Wave Analysis Updates: The service provides frequent breakdowns of major forex pairs, indices, and gold.

- Chart Annotations: It offers clean, numbered wave counts directly on charts for easy reference and understanding.

- Educational Value: The content serves as a valuable learning resource for traders seeking to deepen their knowledge of Elliott Wave theory.

- Free & Accessible: All of the channel's content is publicly available on Twitter, making it highly accessible.

3. Trading Style & Methodology

It is important to note that Elliott Wave Count is not a direct signal provider. Instead of issuing buy/sell signals, it offers trend-based analysis using wave structures. This approach makes it a great supplementary tool for intermediate and advanced traders who are developing their own systems. Given the subjective nature of Elliott Wave analysis, the content should be treated as a perspective to be used alongside a trader's personal strategy.

4. Member Insights & Considerations

Elliott Wave Count offers unique benefits for traders, but it also comes with certain limitations.

5. Final Verdict

Elliott Wave Count is an excellent educational and analytical resource for traders who want to view the markets through the lens of Elliott Wave Theory. It is best suited for experienced traders looking to add another layer of analysis to their decision-making process. For beginners, it is highly recommended to build a strong foundation in Elliott principles first before relying on this type of market outlook.